Economic Justice

We advocate for dismantling systemic inequities and ensuring every Washingtonian has the resources they need to live with dignity.

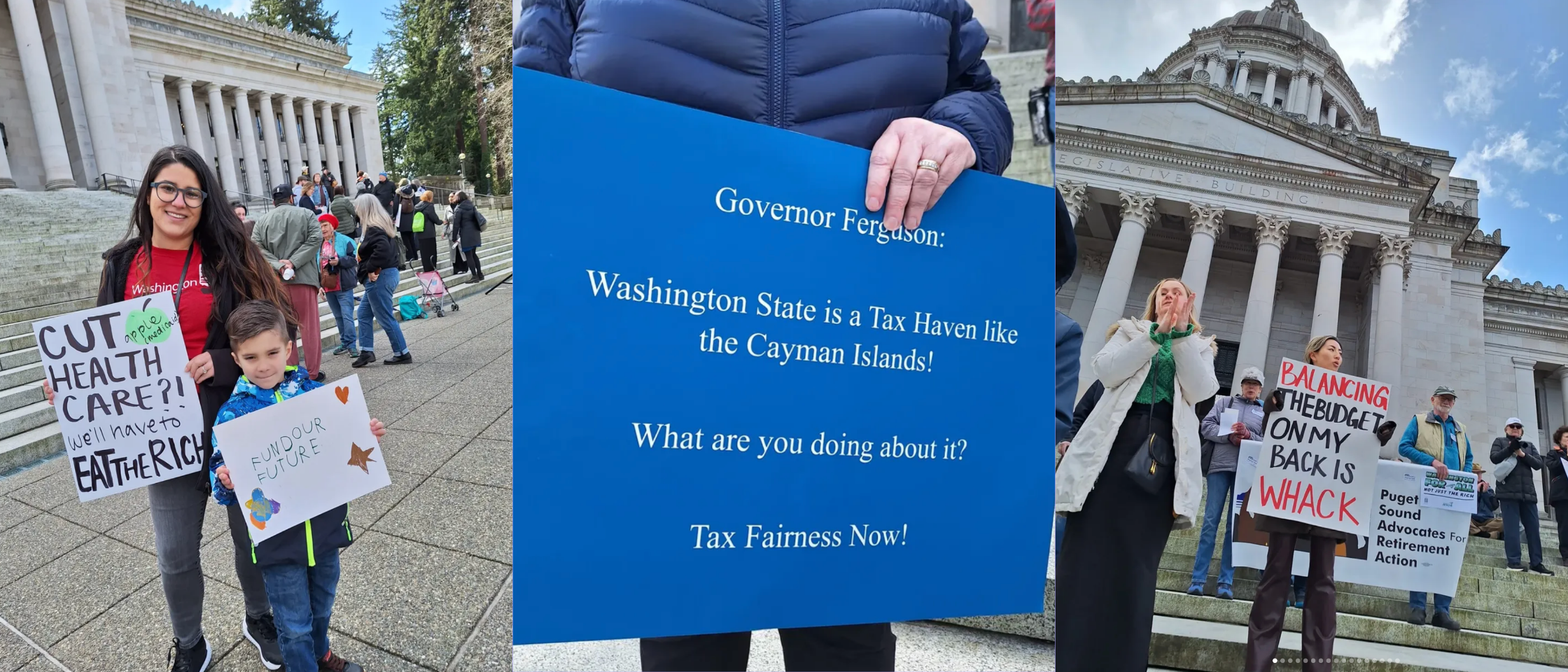

Advancing economic justice means confronting the deeply regressive tax code that places the heaviest burden on working families while protecting concentrated wealth. Low-income communities, particularly communities of color, continue to face barriers created by underinvestment and structural inequity. By prioritizing fair revenue and reinvesting in public goods, we work to build a Washington where economic stability is possible for everyone.

Economic justice

WashingtonCAN’s economic justice agenda focuses on transforming Washington’s tax system so it truly serves the people who keep our state running. Our members have pushed for the Working Families Tax Credit, expanded cash assistance, and pandemic-era relief that kept families afloat. This session, we are continuing that momentum by supporting new progressive revenue proposals, including a wealth-based tax aligned with the Governor’s request for legislation. This measure ensures Washington’s wealthiest households contribute their share so the state can fund housing, healthcare, and community needs.

These reforms aim to build long-term economic stability, reduce racial wealth disparities, and create a fairer system for all Washingtonians.

Learn more about our proposed Economic Justice legislation:

Links to be added to content as bills are filed.